Credit Card Security: Best Practices for Protecting Your Personal Information

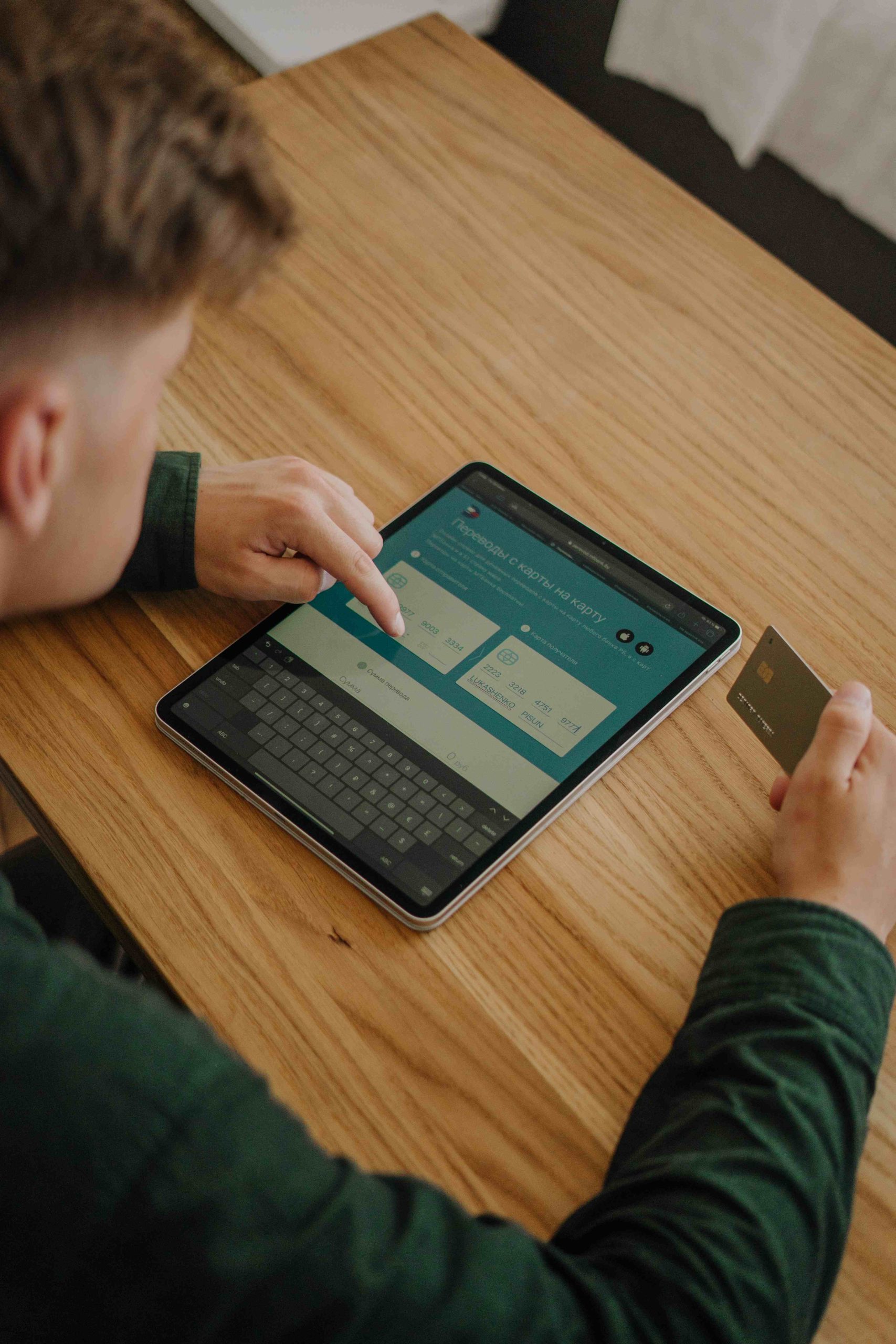

In today’s digital age, credit card security has become increasingly important. With the rise of online shopping and electronic transactions, it’s crucial to safeguard your personal information and ensure the safety of your credit cards. In this article, we will explore the best practices for credit card security, empowering you with the knowledge to protect yourself against fraud and unauthorized access.

Guard Your Card Details:

- Keep your credit card information confidential and avoid sharing it with anyone.

- Be cautious while making transactions in public places and shield your card from prying eyes.

- Memorize your PIN instead of writing it down, and avoid using easily guessable combinations.

Be Mindful of Online Transactions:

- Shop only from secure and reputable websites.

- Look for the padlock symbol and “https” in the website URL to indicate a secure connection.

- Avoid making transactions on public or unsecured Wi-Fi networks.

Regularly Monitor Your Accounts:

- Review your credit card statements and transaction history frequently.

- Report any suspicious activity or unauthorized charges to your card issuer immediately.

- Consider signing up for transaction alerts or notifications to stay informed about account activity.

Strengthen Passwords and Enable Two-Factor Authentication:

- Use strong, unique passwords for your online accounts, including your credit card account.

- Enable two-factor authentication whenever possible to add an extra layer of security.

Stay Updated on Security Measures:

- Keep your credit card company’s contact information readily available.

- Stay informed about the latest security practices and guidelines provided by your card issuer.

- Be cautious of phishing attempts and never share sensitive information through email or phone calls.

Secure Your Physical Cards:

- Sign the back of your credit card as soon as you receive it.

- Keep your cards in a safe place and never leave them unattended.

- Shred or destroy old credit card statements and receipts to prevent identity theft.

Conclusion:

By following these best practices for credit card security, you can minimize the risk of fraud, protect your personal information, and enjoy the convenience and benefits of using credit cards. Remember, being proactive and vigilant is the key to ensuring the safety of your financial transactions. Stay informed, stay cautious, and stay protected in this digital era.

Disclaimer: This article provides general information and suggestions for credit card security. It is always recommended to consult with your credit card issuer or a financial advisor for personalized advice and guidance based on your specific circumstances.